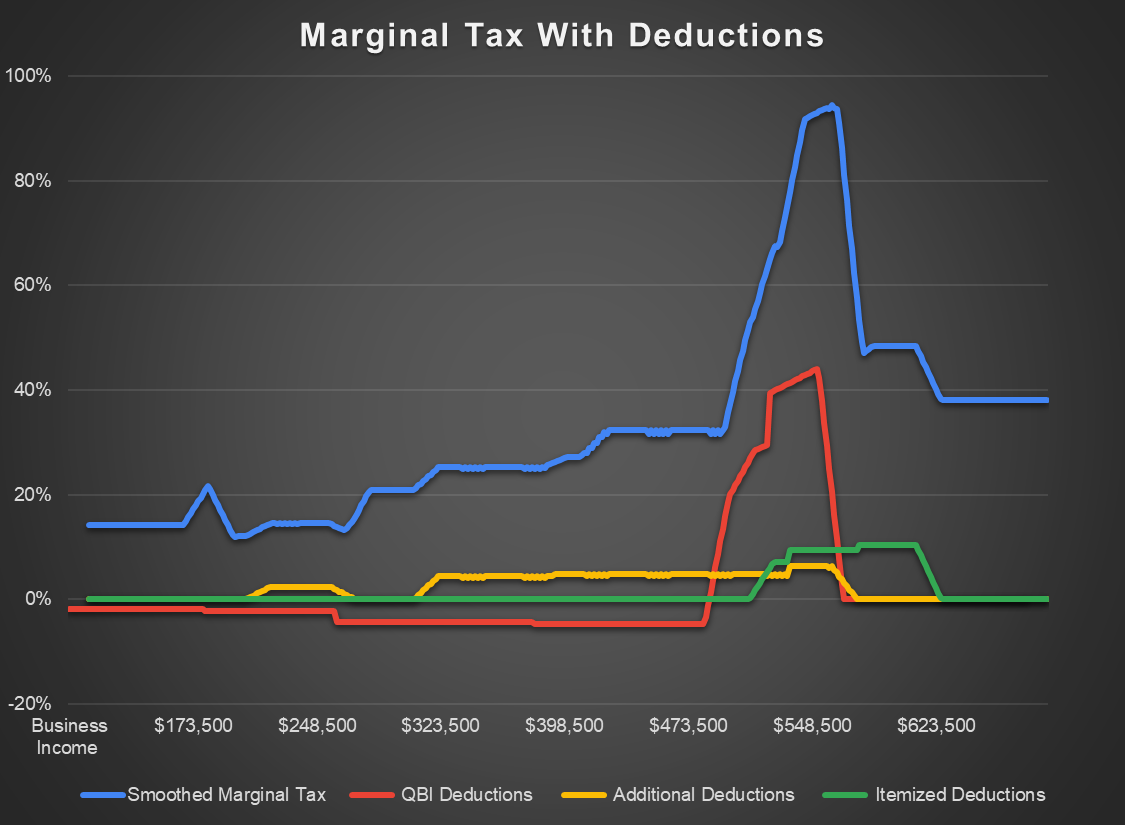

True Marginal Tax Rate

Marginal tax brackets are not your True Marginal Tax Rate (TMTR). The real question clients want answered is “If I earn another dollar, how much do I actually keep?” That’s exactly how we define TMTR: the change in total tax due divided by the next dollar of income.

Stop Guessing: The Smarter Way to Calculate Sch C vs S-Corp Tax Savings

Let’s be honest, most of us learned S-Corp tax planning years ago and still rely on the same rough rules of thumb when talking to clients. The problem is, those “good enough” estimates can be way off once you factor in all the moving parts. That’s why we built the Tax Planning Calculator. It pulls

Should You File as an S-Corp or Stay a Schedule C Business?

If you’re a small business owner or self-employed professional, and had that moment where you saw your Self Employment Tax line on your tax return, you’ve probably wondered how you can pay less on taxes. One way to save money can be to switch from a Schedule C sole proprietorship to an S-Corporation (S-corp). But