Tax Planning Calculator

2025 Edition

Quickly compute the tax savings for Schedule C, S-Corps, and C-Corporations with our professional-grade calculator designed specifically for tax professionals.

Powerful Tools Tax Planning Calculator

for S-Corp & C-Corp

Everything you need to provide accurate entity tax planning services to your clients with

confidence and efficiency.

See It In Action

Watch our comprehensive demo video to understand how the Tax Planning Calculator for S-Corp & C-Corp | TaxFare

can help you advise client on complicated entity choices.

Frequently Asked Questions

Find answers to commonly asked questions about our products and services.

Blogs

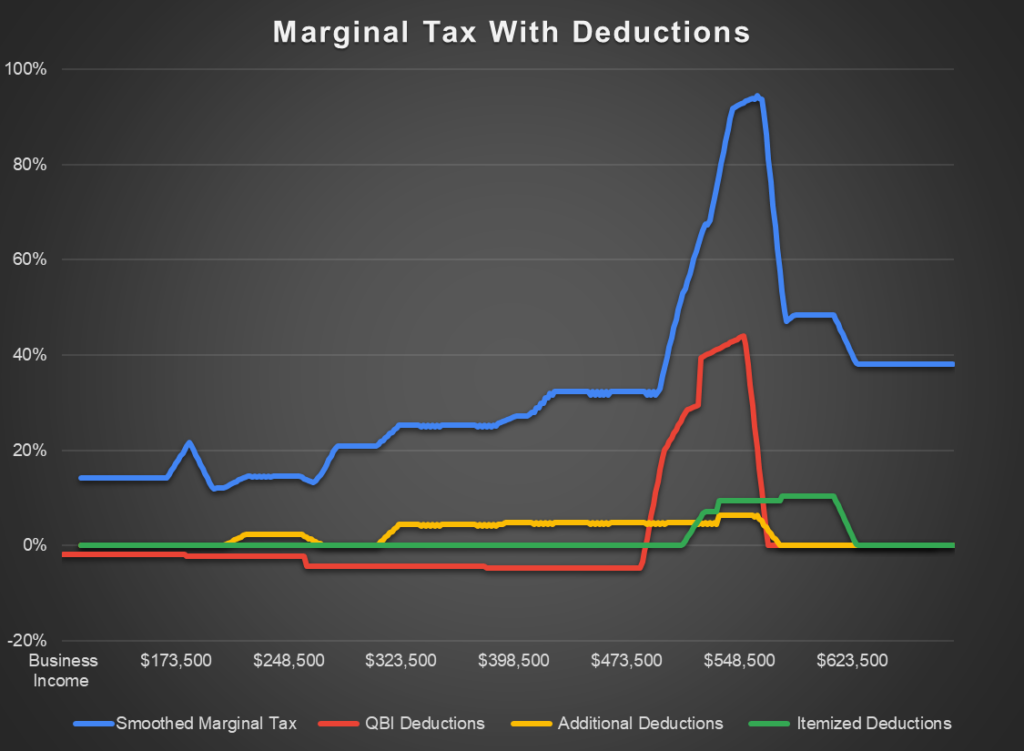

True Marginal Tax Rate

Marginal tax brackets are not your True Marginal Tax Rate (TMTR). The real question clients…

Stop Guessing: The Smarter Way to Calculate Sch C vs S-Corp Tax Savings

Let’s be honest, most of us learned S-Corp tax planning years ago and still rely…

Should You File as an S-Corp or Stay a Schedule C Business?

If you’re a small business owner or self-employed professional, and had that moment where you…